How to Run Financial Risk Management with Machine Learning

In the world of finance, managing risk is crucial. With fluctuating markets and unpredictable economic conditions, companies need to stay ahead of potential losses. Traditionally, financial risk management has relied on statistical methods. However, machine learning (ML) is revolutionizing how we approach risk, offering more accuracy and efficiency. This blog post will guide you on how to use machine learning for financial risk management, using a hypothetical portfolio consisting of three assets: JP Morgan (JPM), Bank of America (BAC), and Morgan Stanley (MS).

Understanding the Portfolio

For this practice exercise, we're assuming that our portfolio consists of three stocks: JP Morgan, Bank of America, and Morgan Stanley. Our dataset contains 85 observations, with JPM having the highest stock price and standard deviation, indicating higher volatility. On the other hand, BAC has the lowest stock price and standard deviation, suggesting lower volatility. This initial information provides us with a basic understanding of the risk-return schema of these stocks.

Computing Stock Returns

To analyze risk, we first compute the stock returns using the log-return formula. The logarithmic return is preferred because it normalizes the return over time, making it easier to compare different time periods. Here’s how you can compute log-returns:

import pandas as pd

import numpy as np

# Assume df is your DataFrame containing stock prices

df['JPM_log_return'] = np.log(df['JPM'] / df['JPM'].shift(1))

df['BAC_log_return'] = np.log(df['BAC'] / df['BAC'].shift(1))

df['MS_log_return'] = np.log(df['MS'] / df['MS'].shift(1))

# Drop the first row which will have NaN values

df = df.dropna()

Setting the Stage for Risk Analysis

In our scenario, the value of the assets exposed to market risk is 1 million USD, and we are looking at a 5-day holding period with a 95% confidence level. With three assets in our portfolio, we need to assign weights. For simplicity, let’s assume equal weights for each stock:

weights = np.array([1/3, 1/3, 1/3])

Machine Learning for Risk Management

Now, let’s dive into how machine learning can be used for financial risk management. We will focus on two key areas: Value at Risk (VaR) and Expected Shortfall (ES).

1.Value at Risk (VaR)

Value at Risk (VaR) is a statistical measure that estimates the potential loss in value of a portfolio over a defined period for a given confidence interval. To calculate VaR using machine learning, we can use techniques like Monte Carlo simulations, which involve generating a large number of random scenarios for future stock prices and then calculating the potential losses.

# Monte Carlo Simulation

num_simulations = 10000

simulation_df = pd.DataFrame()

for x in range(num_simulations):

simulated_returns = np.random.multivariate_normal(mean_returns, cov_matrix, len(df))

simulated_price_df = pd.DataFrame(simulated_returns)

simulation_df = simulation_df.append(simulated_price_df)

# Calculate the portfolio returns

portfolio_simulation = simulation_df.dot(weights)

# Calculate the VaR

VaR_95 = np.percentile(portfolio_simulation, 5)

In this code snippet, mean_returns and cov_matrix are the mean returns and covariance matrix of the log-returns respectively. The VaR_95 represents the 95% VaR, indicating the maximum loss expected with 95% confidence.

2.Expected Shortfall (ES)

Expected Shortfall (ES), also known as Conditional Value at Risk (CVaR), measures the average loss that occurs beyond the VaR threshold. It gives a more comprehensive picture of the tail risk.

ES_95 = portfolio_simulation[portfolio_simulation <= VaR_95].mean()

Advanced Machine Learning Techniques

While the above methods use basic Monte Carlo simulations, advanced machine learning techniques like neural networks, support vector machines (SVM), and reinforcement learning can offer more sophisticated risk management solutions.

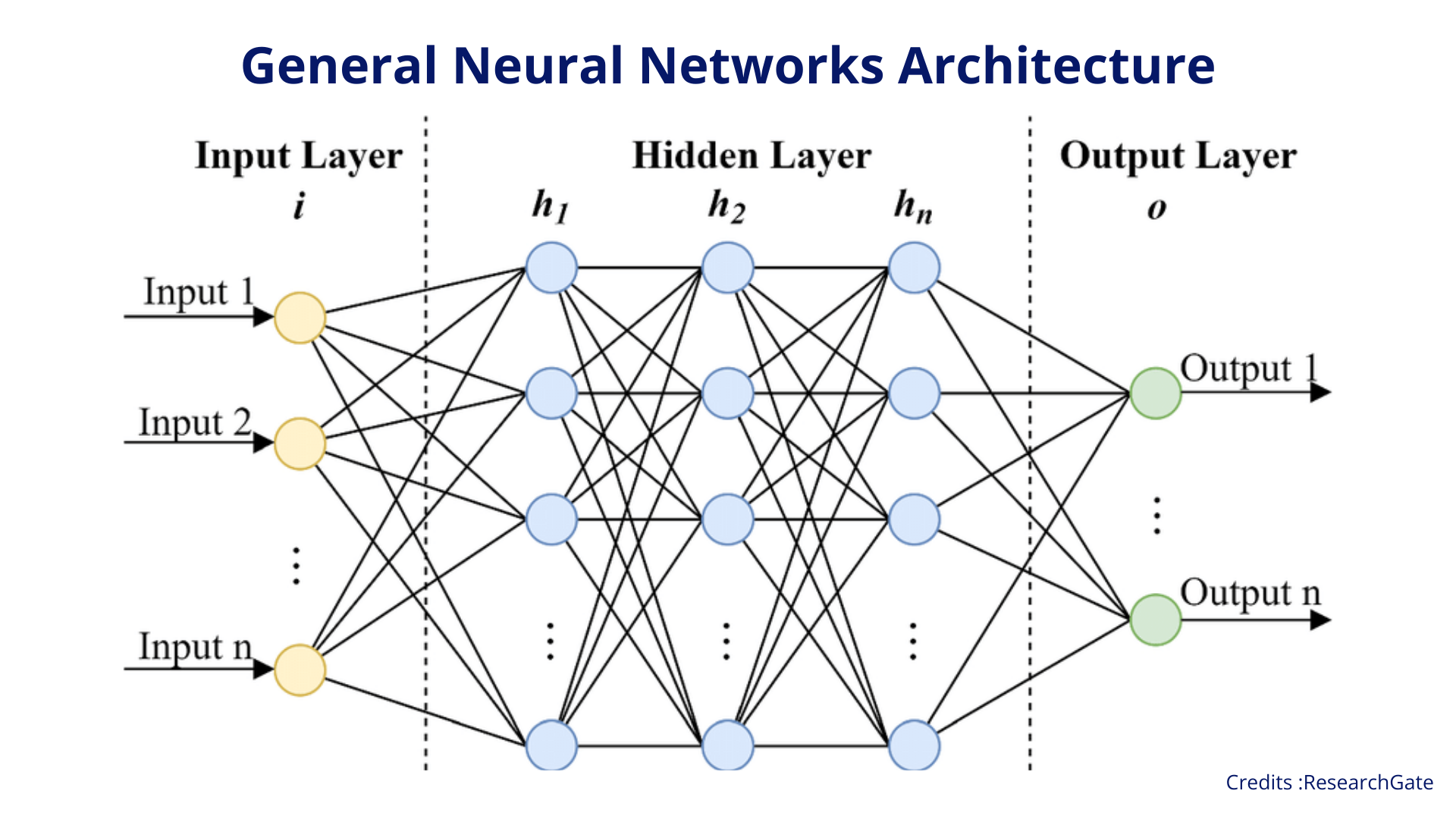

Neural Networks

Neural networks can model complex, non-linear relationships in financial data, providing more accurate risk predictions. They can be trained on historical data to predict future market conditions and assess risk.

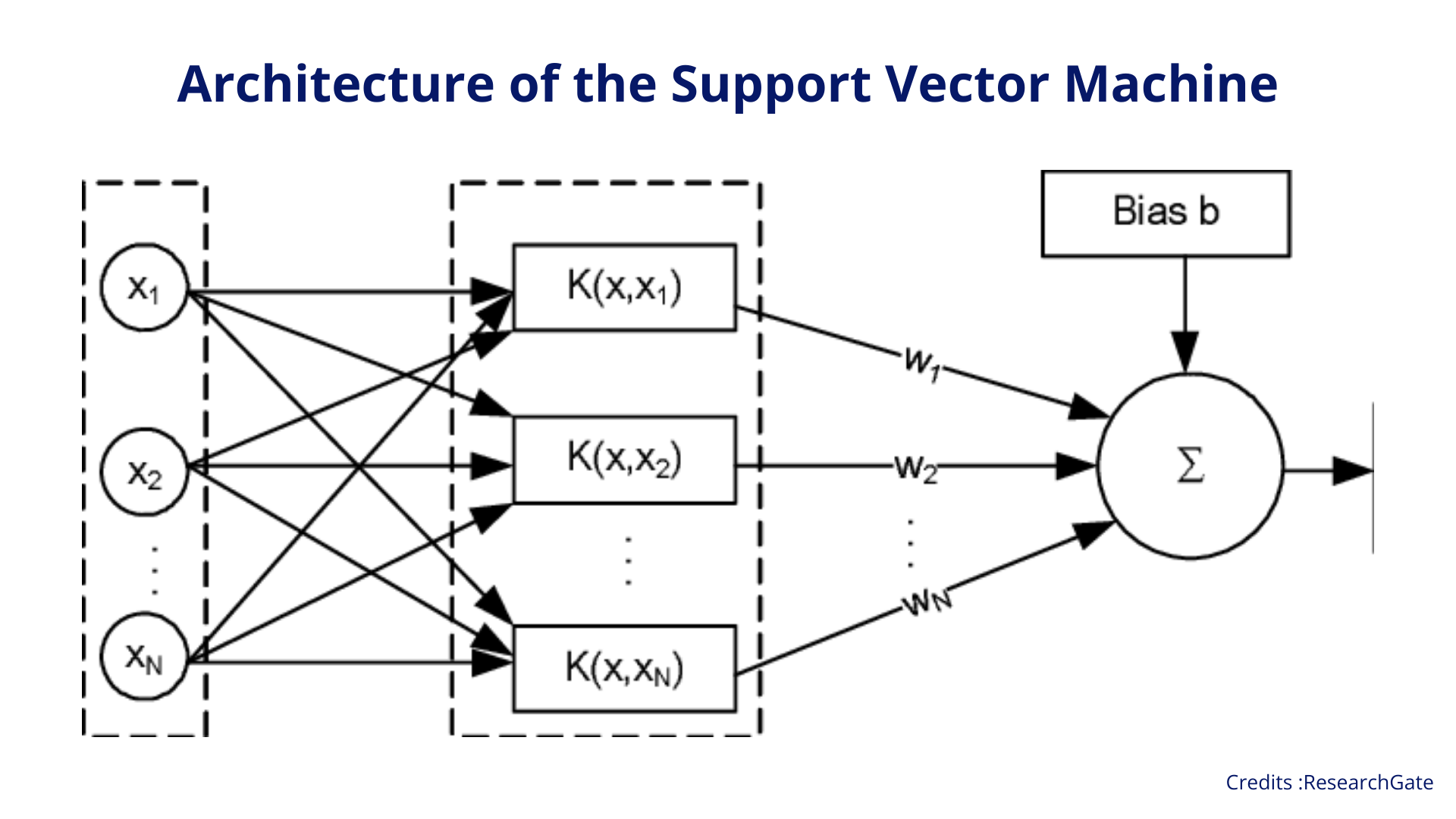

Support Vector Machines (SVM)

SVMs can classify data into different risk categories, making them useful for identifying high-risk scenarios. By training an SVM on historical market data, you can classify future market conditions and adjust your portfolio accordingly.

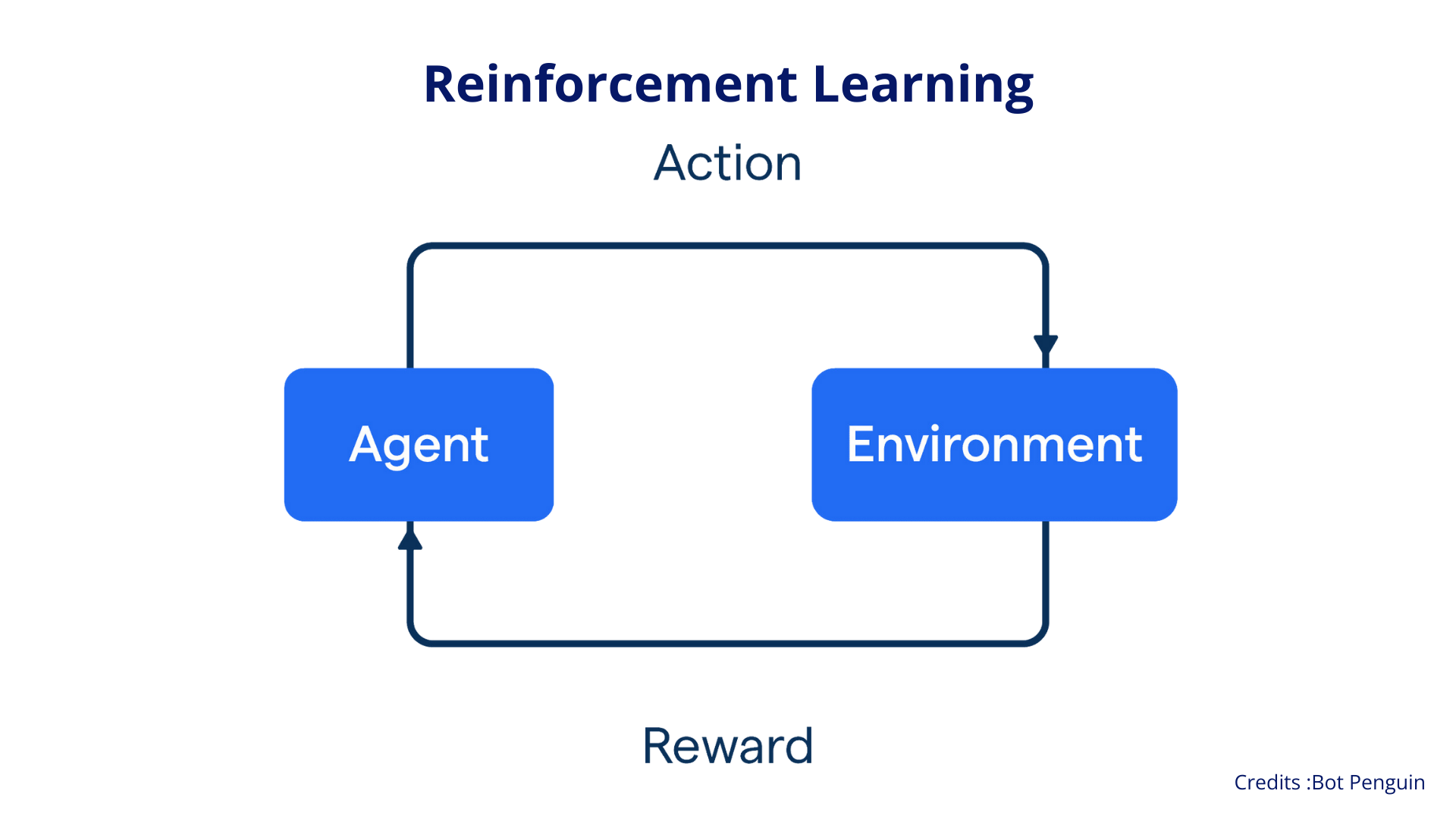

Reinforcement Learning

Reinforcement learning algorithms can learn optimal strategies for risk management by interacting with the market environment. These algorithms can adapt to changing market conditions and continuously improve their risk management strategies.

Conclusion

Machine learning offers powerful tools for financial risk management, providing more accurate and efficient ways to predict and mitigate risk. By using techniques like Monte Carlo simulations, neural networks, SVMs, and reinforcement learning, companies can stay ahead of market fluctuations and protect their assets.

In our hypothetical scenario, we demonstrated how to compute Value at Risk (VaR) and Expected Shortfall (ES) using basic Monte Carlo simulations. However, the potential of machine learning in financial risk management extends far beyond these methods, offering endless possibilities for innovation and improvement.

As technology continues to advance, it is crucial for finance professionals to embrace machine learning and leverage its capabilities to improve their risk management strategies, which is why we at Leveragai offer consulting services with our advanced machine learning models. Whether you manage a portfolio of three stocks or thousands of stocks, our machine learning models can help you navigate the complexity of financial markets and achieve better results.

At the same time, by integrating our models into your risk management practices, you can gain deeper insights, make more informed decisions and ultimately protect your financial assets in an ever-changing market environment.